How’re you all doing? Miguel’s family had a scare – his wife was very poorly for 3 weeks but is much better now. David, self-isolating in his bunker, has been grumbling about Government spokespeople listing the criteria for those considered particularly high risk which seems to include everything pertaining to him apart from his postal code! He’s peevish, too, that he sees more of the Tesco grocery delivery guy than his grandchildren.

Here’s some thoughts on the wider protein market and what it takes to do well. We’ll sneak in a few points on Covid-19 and its impact on the food industry at the end because one’s obliged to but, largely, this is a coronavirus-free blog.

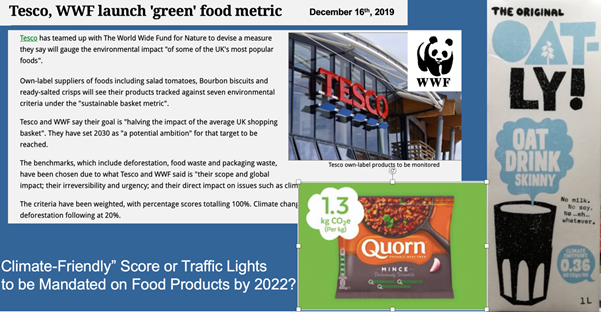

There is a clear global mega-trend towards more climate-friendly and planet-friendly foods driven by younger consumers (your children and grandchildren), the UN and several of its agencies, and individual governments. The influential and occasionally irritating Greta Thunberg plus a legion of social media activists have captured the lion’s share of media attention but, this is no fad, and planet-friendly views will be reinforced in the aftermath of this round of coronavirus. Not a loony special interest group but UBS, a traditional conservative Swiss investment bank opines that “the plant-based food category is expected to surge to US$85bn. over the next few years as people seek out alternative options to meat that are more environmentally-friendly”. Whether we like it or not, there will be “enviro-traffic lights” on foods just like there are health traffic lights now (“nutri-scores” in EU parlance) – enviro-labelling is already in the market place.

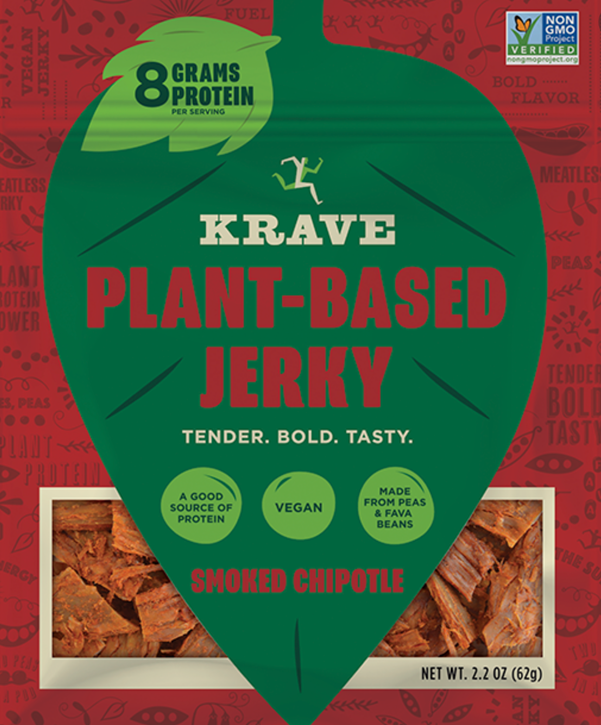

Time to panic for the global meat industry? NO: increasing the protein content of the diet is seriously on-trend and the envy of carbohydrate and sugar producers. Savvy producers of meat and plant protein products (e.g. new age jerky snacks and cereal-based “health” bars) are quick to highlight their protein credentials on front of pack, let alone on the ingredient list on the back.

Who are these interlopers seducing consumers with new protein options?:

- Krave meat and plant-based jerky – owned by the iconic chocolate bar owners Hershey;

- Nature Valley – owned by “Big Food” General Mills;

- Kellogg’s – aren’t they the breakfast cereal people?!

The arrival of “Big Food” into the protein snack market ups the competitive ante for traditional meat companies and “Big Food’ comes with considerable consumer marketing skills and nous.

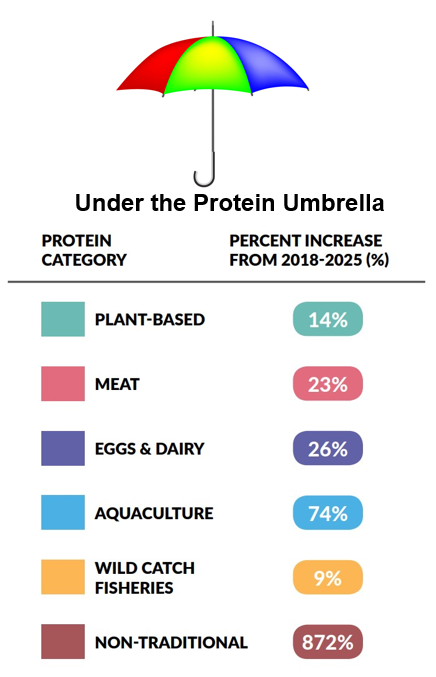

Global protein consumption grew by 40% between 2000 and 2020 and, over the next 5 years, it’s expected to increase by a further 15%. But, remember, there’s much more than meat under the protein umbrella:

- Plant-based protein is the largest protein category but it’s growing much slower than others;

- Eggs and dairy are increasing like an express train;

- Chicken, pork and fish/seafood dominate the overall meat category and are in very healthy growth (although, ASF will constrain supply growth in the short- to medium-term);

- Aquaculture is the fastest growing category – particularly for Asian-grown basa (pangasius) and tilapia;

- Wild catch fish is the slowest growth category with sustainable supply being a big issue;

- “Non-traditional” protein (composite category including “fake” plant-based meat and insects) is in spectacular growth but from a tiny base;

- Emerging Asia and Africa are the regions were consumption is in fastest growth with Europe and higher income Asia being the slowest;

- And China has the world’s largest total consumption share and this will continue through this decade.

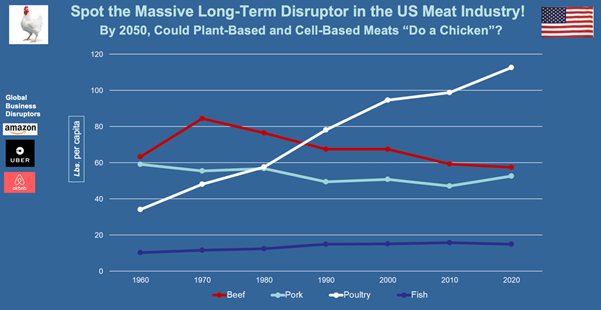

We’re getting used to global business disruptors such as Amazon and Alibaba in grocery, Uber in personal transport, and Airbnb in room rentals (it took Hilton 100 years to accumulate 250,000 rooms across the globe and Airbnb a decade to top the million). Could plant-based and cell-based meats be the mega-disruptors in the global meat industry in the decade we’ve just entered? Let’s take a look at a massive long-term disruptor in the global meat industry and use the impact of chicken in the US as our example. Over 60 years, chicken has come from lowly levels to dominate the US meat scene. Beef has drifted lower year-by-year for 50 years and pork struggles to maintain historic consumption levels.

What accounts for the success of chicken?. It has out-performed other meats on the consumer’s check list but, along with the others, struggled on the citizen’s check list. The former list comprises the attributes of chicken that are consistently identified in meat market research around the globe. Chicken is seen as being:

- Affordable;

- Healthy and nutritious;

- High, quality protein content;

- Versatile;

- Snackable;

- Easy to add taste;

- Can be eaten hot and cold;

- Kids like and will eat without a fuss;

- Food service favourite and suits fast food;

- Widely available;

- Increasingly, fits all meal and snack occasions (see McD’s and Chicken for Breakfast);

- Often, has local provenance (e.g. British chicken, Farmer Smith’s);

- Products are consumer-orientated (e.g. nuggets), not carcase-based product names;

- Wide product range;

- Decent shelf-life;

- Largely seen as safe – notwithstanding occasional salmonella and campylobacter scandals and chicken flu (avian influenza) issues in foreign markets;

- Religion neutral.

Competitors must look at their products through consumers’ eyes and honestly measure the performance of their protein against the long list of chicken attributes listed above. Processed pork products probably come closest with their affordability and convenience attributes being key.

What about the citizen’s checklist? Here, chicken does less well but leads on climate-friendly and environmentally-friendly vis-à-vis its land-based meat competitors. Arguably (in the eyes of consumers), plant-based and in prospect cell-based meat proteins score higher on citizen attributes such as climate/environment, human health, and animal welfare. Eco-active consumers, some universities (e.g. Goldsmiths, University of London, University of East Anglia Student Union) and some public sector food service divisions are increasingly modifying their food purchases on the basis of citizen issues (with beef being a particular target). They wish their purchases to “make a difference” to an ever growing list of social issues. So, what about the relative weightings of consumer attributes and citizen attributes? We’re not sure: the importance of citizen attributes are growing fast BUT for the majority of consumers, consumer attributes trump citizen attributes when push comes to shove (a bit like convenience trumps health in food product selection). In many countries facing real declines in household income over the next few years, the eco-purchase may be more aspirational than practical when the family food budget is tight.

Could “Fake Meat’ Out-Chicken Chicken? Only if its performance on the consumer and, to a lesser extent, citizen attributes outperforms chicken. That’s unlikely to happen in a hurry. In the medium-term, plant-based meats and cell-based meats later will have a significant place in the overall market but only modest relative to the real thing. In the longer-term, cell-based meats may be the massive long-term disruptor. We’re a long way from seeing “fake meat” steaks, fillets and chops, but comminuted products such as burgers, sausages and nuggets are already with us and will only grow in market importance. Remember, there’ll be a veggie in the majority of households by mid-decade and the purchaser and preparer won’t want Brenda to veto the meal!

Now, if we still have your attention, we’ll slip in some top of mind thoughts on the Covid-19 pandemic and its impact on the global meat industry:

- We are facing a deep global recession – i.e. sharply falling real household incomes in many maybe most countries – this will increase demand for food staples (the relatively cheap everyday items that are core to our diets and fill our tummies) and decrease demand for premium foods. From a meat perspective, that benefits chicken and farmed fish, presents a strong challenge for premium-priced beef and lamb, and is so so for mid-priced pork;

- Asian economies will recover quicker than Europe and North America – good news for export-orientated meat companies;

- The picture for pork is less predictable – the impact of African Swine Fever and the time it takes for particularly the Asian pork industry to recover will determine how long global pork demand remains strong, irrespective of the Covid-19 impact;

- Currently, there is no direct links between Covid-19 and food and its packaging (i.e. concerns about being infected from touching/eating specific foods is very low relative to concerns about infection from other humans). However, watch this space and expect supply chain slowdowns because of increasing food safety checks at borders;

- Global food supply chains are robust, particularly for long shelf-life commodities (e.g. grains, oilseeds) but unexpected supply chain disruptions for meat products (e.g. ASF, AI, unpredictable climate events, nasty trade spats) will add to business risk;

- Mid-pandemic crises will cause food processing disruptions – e.g. the labour shortages resulting in Tyson, JBS and Cargill closing meat packing plants in the USA this month;

- Hiccups in availability for food through the pandemic will drive long-term concerns about food security and result in both government and consumers seeking more local/domestically-produced meats;

- Concerns in Asia about food safety will drive accelerated declines in traditional, wet markets as the principal source of supply for fresh foods to the advantage of modern retail. This is a plus for meat exporters to Asia;

- In Western and higher income economies in general, concerns about the provenance of food products and their ingredients, how they are produced, by whom, and whether the values of the producing company are in tune with its customers will only grow as we come out of the coronavirus crisis and have more weight in the purchase decision;

- This coronavirus period has accelerated the adoption of online grocery shopping because of positive experiences during lockdowns – this is a threat to traditional supermarket companies but a clear opportunity for those that are progressive;

- Closing down of restaurants and the food service sector in general is encouraging home cooking and ingredient box companies (e.g. HelloFresh, Mindful Chef, Gousto). Post-pandemic, will we return to the cafés and restaurants? Big time! But, a proportion of consumers will feel more comfortable in the kitchen and their lower incomes will encourage them to eat more often at home;

- If we have (God forbid) re-occurring coronavirus pandemics, intermittent periods of panic buying will reoccur and, sadly, food wastage will increase.

Keep up the hand-washing, social distancing and self-isolating and do keep well.

Our very best David and Miguel.