This week, the 25th City Food & Drink Lecture in The Guildhall, London, addresses the question “Can the food & drink industry make the next 25 years healthier than the last?”. If consumers could be convinced to eat (or drink) more fruit and veg. that’d be very helpful but we’ve got only a modest track record of success! Is this a British problem? Far from it. Per capita consumption of fresh fruit & veg. has slipped backwards in Australia, New Zealand, Canada and USA, amongst others. Across the entire fresh produce market, are all consumer age groups fruit & veg. slowpokes?:

- children under-consume vegetables and have done so for decades (“don’t like to try/the taste of vegetables, not exciting/uncool”). There are encouraging initiatives such as VegPower in the UK and The Wiggles Yummy Yummy in Australia to redress the decline but it’s back-breakingly hard;

- adults under 40-year-olds aren’t much better than the kids, shopping less frequently than their elder peers for fresh produce in supermarkets and are much more likely to demand their fruit & veg. in ready-to-eat snack and mini-meal form (smoothies, bowls, etc.);

- even ageing “Boomers” (60+ years) are eating less reflecting that portion size tends to decline with age and on bitey produce there’s their teeth, of course! Mind you, we’ll miss them when they’re gone as, in Australia, 55+ year olds have a 40-50% greater fresh produce consumption than those younger.

Declining per capita consumption of fresh fruit & vegetables, particularly if it’s based on retail sales via supermarkets and traditional greengrocers, may seem worrisome, but this doesn’t capture total fruit and vegetable consumption which includes canned, frozen, dehydrated and fresh processed which are sold in regular and alternative retail outlets and alternative product forms. Three examples come to mind:

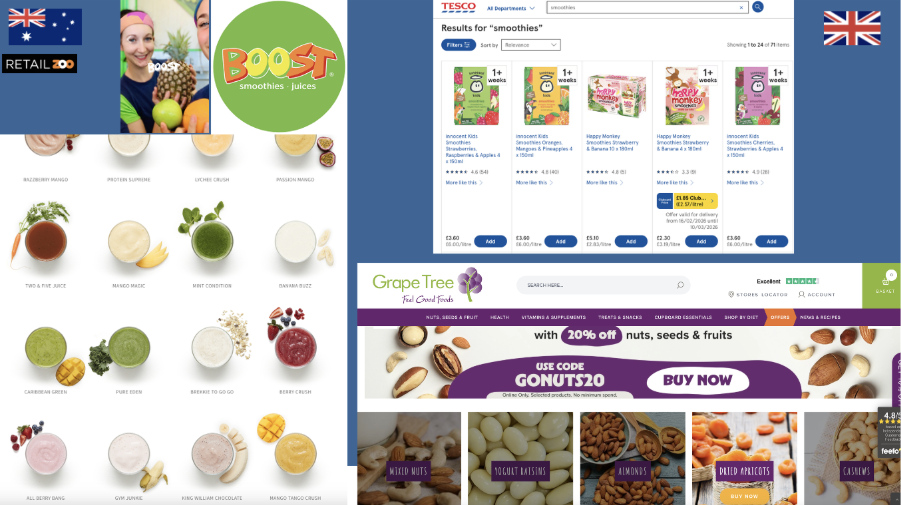

- juices and smoothies festoon the retail shelves of our supermarkets. Click “Smoothies” on Tesco.Com and there are 71 choices and 195 if you click on “Juices”. The hugely popular “meal deals” invariably include a fruit/veg. snack or drink;

- Boost Juice making fruit & veg. smoothies in 16 countries around the world (including Australia its “home”, New Zealand and UK);

- and Grape Tree in the UK with close to 200 stores selling nuts, seeds, dried fruit and more at very competitive prices to the major grocery retailers.

Clarence Birdseye introduced the world to frozen peas 100 years ago and, if you eat broad beans, when did you last buy them fresh? Frozen products increasingly dominate the potato market globally (who makes chips/French fries from scratch?). A wide range of frozen field veg. prospered during the 1950/60s only to be beaten back in the UK as supermarkets extended their global procurement of fresh produce. Yet, frozen sales made a comeback through “lockdown” in the very early 2020s and blenders such as nutribullet take the labour out of breakfast smoothie-making from both fresh and frozen even for “I want it NOW” Gen. Z consumers! In New Zealand, frozen, dried or pickled produce are the only options during the domestic fruit & veg. off seasons as ALL fresh produce imports are banned.

Seven out of ten households in the UK, Australia and New Zealand have an air fryer (3rd most popular kitchen appliance after the toaster and microwave) popular because of speed of cooking and energy efficiency. Its arrival has boosted sales of frozen meat and vegetables, not least hard Winter vegetables like sweet potatoes, swede, squash and brassicas such as Brussels sprouts. Keep them in the freezer and there’s no worries about shelf life and product waste that we have with the fresh items.

For many households, the form of what food and when/where we eat it is principally about convenience (n.b. convenient: the state of being able to proceed without difficulty). A recent Horticulture Australia consumer survey concludes that the biggest barrier to increasing fruit & veg. consumption at home is “lack of time and energy”: “I don’t have the time to plan, shop and prepare more … vegetables”. It’s no different in UK or New Zealand. Clearly, the outlook for pre-prepared fruit and veg. products looks good. For frozen and chilled, fresh prepared there’s no or very little UPF (Ultra Processed Food) perceptual barrier. Just ensure the ingredient list is short and natural.

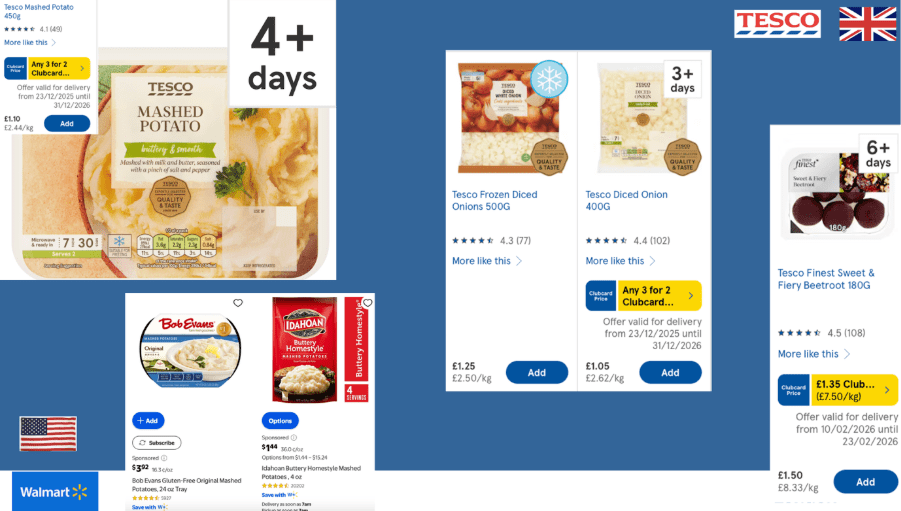

Keep an eye on the uptake of chilled ready mashed potatoes. NEVER in this household, you say! Well, maybe occasionally if I’m desperately short of time. Ooops, it’s become a routine purchase. The ingredients? Potatoes, milk, butter and a pinch of salt & pepper – not too scary! Tesco.Com has 20 mashed potato skus. Take a peek at Walmart’s offer in the USA. It has 720 mashed potato skus and, coincidentally, most are supplier branded, i.e. not supermarket own label. Onions are edging in the same direction – no more crying! We bet you haven’t boiled or pickled a beetroot in a decade.

Irrespective of whether fruit & vegetables are fresh whole/fresh prepared, frozen, pickled or whatever, 2 mega consumer trends are blowing a gale of consumer demand in our direction. First and gaining strength through the COVID period and up to this day is Gen. Z (under-30s) fuelling demand for healthy food products compared to older generations. Across the adult age ranges there are wellbeing concerns that recognise what we put in our tummies is an integral part of improving mental, physical and global environmental health. Second, there’s the anticipated impact that GLP-1s (Anti-Obesity Medication) is and will increasingly have on global diets as the medication moves towards pill form and at much lower prices. Early USA survey data shows that users feel better, eat less and eat healthier – bad news for the savoury and sweet snack sector, and for the fast-food sector as is, but very good news for those in the wider fruit and vegetable industry. After “clean” protein, fruit and veg. comes second on GLP-1 users must consume more list.

The future for the fruit and vegetable industry seems set fare. But …. as Gen. Z consumers drift into middle age and accumulate children, they just won’t develop an irresistible desire to prepare beef and Winter vegetable stews from scratch or yearn for difficult to peel citrus, even slicing melons may be challenging. Food and drink that is convenient will rule and convenient, to repeat, means I want it NOW! The notion of purchasing food ingredients will remain mysterious for most and they’ll seek meal components that they can bolt together into “a home cooked meal” or just buy the snack/mini/main meal in toto from a store or have Just Eat, Uber Eats or Grab (in Asia) deliver it. The implication of this for fresh produce producers and suppliers is that there will be another link in the chain between them and the consumer. Globally, the fresh produce industry is consolidating at speed. Expect to see the big players expand and cover all of the fruit & vegetable product formats – fresh, fresh prepared, frozen and more.

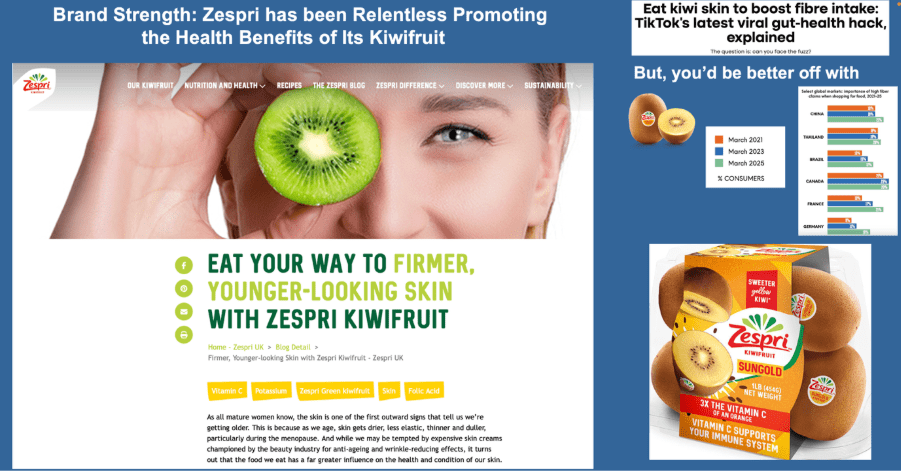

Finally, on health, we’ve talked before about how poor the fresh produce industry has been about communicating with consumers on the specific health attributes of their products. There are exceptions and Zespri comes to mind advising consumers that eating more kiwifruits will result in firmer, younger looking skin, and that kiwifruit Vitamin C levels knocks oranges into a cocked hat. Globally, consumers are seeking food with high fibre content. Shouldn’t this be, pardon the expression, one of our trump cards? Ask consumers in any survey “are fresh fruit and vegetables healthy for you and your family?” and they’ll nod with that “everyone knows that”. We need to be more specific as in “it’s good for …” and add in a health attribute that is important to them and for which we have genuine scientific research evidence.

David Hughes and Miguel Flavián

February 22nd, 2026