Who’s top of the global league in land-based meat consumption? It’s chicken, but that wasn’t the case 12 years ago. Whereas ALL the major meats (chicken, pork, beef, lamb) have seen global market growth since 2013, chicken has screamed ahead tipping pork from the top position: in 2025, chicken has a 41% global meat market share (up from 36% in 2013), pork has a 34% share (down from 38%), lamb holds steady at 5% through this period, and beef has slipped from 22% to 20% global share (Gira estimates). Over this12 year period, our world population has increased by 1 billion and is responsible for driving the 20% total increase in meat volume sales. However, if your measure is meat consumption per capita, chicken rose by 23%, minor meat lamb saw some growth, whereas pork and beef drifted lower.

Likely, the position of red meat, struggling since the pandemic through a prolonged “cost-of-living crisis”, from a consumer perspective, will continue to see thin times in terms of growth. Browse the UK supermarket shelves for your Sunday roast: chicken is astonishingly affordable at less than £3/kg.; pork at £7.50/kg.; leg of lamb at £16/kg.; and beef at £19/kg. – a clear indication that there are meats for the “Income Haves” and for the “Income Have Nots”. The latter, often, 40% or more of all households perceive they have little option than to seek high calorie-low price meal options for their families – a 30 pack of breaded chicken nuggets, plus 1.5kg. of frozen French fries, and, say, 2 “snacking” small pizzas costs £4.65 ($6.26) to feed a family of 4 or 5 from Tesco (and these items are all Aldi price-matched). That amount will barely buy you a couple of lamb chops!

Consumers are not doomed to a low-income growth future and, in many countries, when the tide turns, meat consumption will tick up. People in richer countries tend to eat more meat and, certainly, more premium meats. There are outliers where incomes are relatively low but beef consumption is high – BBQ-loving Brazil with its churrascos and Argentina with asados come to mind. Mind you, high income countries don’t necessarily see sustained growth in meat consumption and the UK is a case in point. Our per capita meat consumption has drifted down over the past 20 years, BUT overall meat market volumes have grown as our total population has increased by 10 million over this period. Like most European countries, Australia & New Zealand, USA and Canada, population growth has been driven by incomers and reminds one that it’s handy to keep a tab on the meat preferences of the newer arrivals.

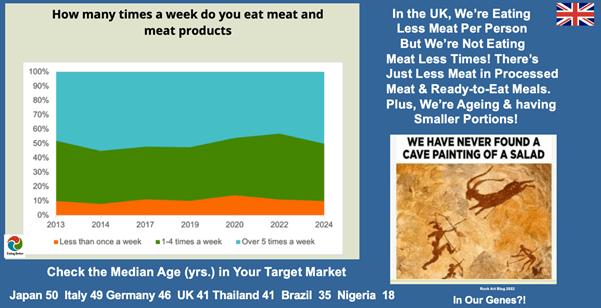

So, in the UK are we going off meat? Far from it! We’re eating less meat per person but we’re not eating meat less times. Our meals, even savoury snacks, may be meat-based but there’s less meat in meat portions, ready meals, sausage rolls/pasties, etc. and we are an ageing country. Old folk eat less. UK median age is 41 but that makes us youngsters relative to Germans (46), Italians (48) and the ancient Japanese (50)! And look, with some country exceptions (e.g. Bangladesh), the world loves meat and are VERY reluctant to give it up notwithstanding exhortations about the impact of animal production on the environment and on our health if we are meaty over-indulgers. Meat consumption is in our genes. As the brilliant cartoon showing stick like stone-age figures hunting game advises “We have never found a cave painting of a salad”!

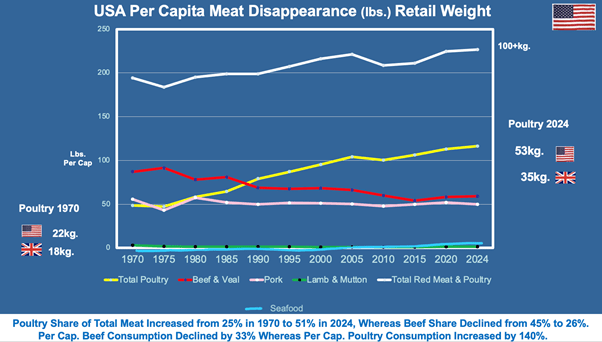

In the USA, poultry (specifically, chicken) is King of The Coop. Overall meat consumption continues its slow but seemingly inexorable upward movement and reminds one that, in America, if something is worth doing, it’s worth doing to excess! Of the 100+kg. per capita of meat consumed each year, poultry accounts for 51% of total, up from 25% back 50 years ago, beef’s share has dropped from 45% to 26%. Per capita pork consumption was above chicken in 1970 at around 25kg. and it remains at this level to this day, whereas per capita beef consumption has declined by 33%. Lamb is essentially a specialty meat in the USA and the cayotes eat more domestically produced lamb than do its citizens!

Addressing the market position of chicken, why is it so successful? Straight off, it’s relative low price and, through time, the relative ease of deconstructing the carcase with machinery not labour. But, back to the USA again. In 1970, per capita chicken consumption was 22kg. (18kg. in UK) and by 2024, it was at a meaty 53kg. (35kg. in UK). In the 1950s in most British families, chicken was for Christmas, now, it’s “Chicken Tonight”! Chicken has been consistently closer to the consumer and to emerging trends than the red meats. McDonald’s NPD and promotional oomph has been helpful – in the USA, it launched “Southern Style Chicken Biscuits” for breakfast in 2008 and pushed the chicken breakfast boat out comprehensively nationwide with Chicken McGriddles in 2020. The relaunch of the McDonald’s Snack Wrap in July 2025, gained international headlines in the popular press. If you can add another eating occasion (e.g. breakfast, mid-morning snack), then, whoop-de-doo!

As diets around the world have become more international (e.g. Indian, Mexican, Chinese, Thai), the focus has been more on the sauce than on the meat species and, because of its price, chicken has become the default meat option. Additionally, chicken meals are seen, often, as being more versatile and family-friendly than other meats (kids like chicken, well nuggets) and have no religious barriers. As life has picked up speed, we’ve changed the way we eat and drink. More recently, traditional meal patterns (“3 meals a day”) have fallen away and now, mini meals and snacks are increasingly prevalent. As Kantar aptly puts it, “what was once called “convenience” has become something more – flexibile (and, a vital companion, affordable). It’s more than grabbing something on the go or just being super quick, it’s about finding food and drink that can bend, twist and fold itself into the unpredictability of modern life”. That’s chicken!

Keep your eyes on Generation Z (i.e. consumers who are in the age range 13 to 30). They’re 4 times more likely to select “grab & go” meals/snacks than ageing boomers. How do they define convenience? Succinctly, now means NOW. Processed chicken products are the default choice and air-frying the means of final meal preparation. Increasing protein intake is fashionable for those in their late teens and early twenties. Again, chicken fits the bill. In the UK, the range of The Gym Kitchen products hits the mark. In the USA, Tyson offer NFL Kansas Chiefs nuggets. What about Liverpool FC “Reds” chicken bites? Keep in mind, meat isn’t the only protein source, and the market is getting crowded, not least with dairy products and nuts.

Captain Birdseye’s seafaring days may be limited. He’s heading for the shores and the chicken shed – note BirdsEye chicken (not fish) fingers, and chicken (not potato) fries. Perdue “Sea Creature chicken nuggets” has enough cheek for another row of teeth with its “fun shapes of fish/turtles/shrimp/octopus” made from chicken.

Meat sticks are becoming America’s favourite new snack, and we’ve moved on without displacing biltong. There’s room for all meats to do well here but, in the UK, chicken snacks are leading the charge. There’re even crisps (chips in the USA) made from chicken breast and chicken crackling (fried chicken skin) sitting aside the traditional favourite pork scratchings.

Remember that close to 40% of UK households have a family member that isn’t human – the dog, that is, not the difficult partner or child. Mabel, the “Sprocker” in David’s home, demolishes 1kg./week of Tesco’s chicken thighs giving her a per capita consumption 50% above average for our nation! Spoilt rotten? Undoubtably, but at £3/kg. courtesy of the low fresh chicken price, it’s the same cost as a can of Butcher’s Tripe dog food!

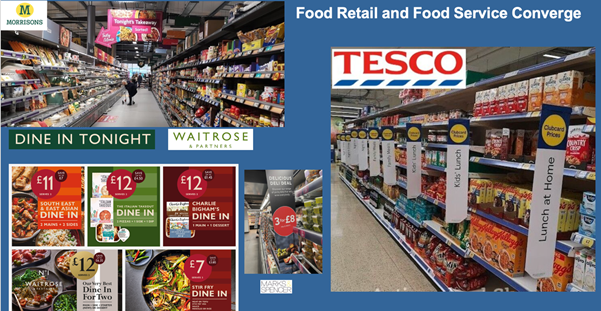

Will chicken retain its paramount position amongst meats? Browse the meat aisles in our supermarkets. Chicken gets 3 times the shelf space of beef and 5 times that of lamb (for goodness’ sake, in Waitrose, Charlie Bigham’s posh ready meals get double the space of lamb). Pork holds its own courtesy of serried shelves of bacon and sausages. But, move over an aisle and you’re into stacks of prepared meals, easy meals, the “that’s dinner sorted” and snacking & sharing sections. In these areas, chicken has a disproportionate share of the protein on offer. In short, we’re nowhere near “Peak Chicken”. Pork, in its processed form, has opportunities here to build on its traditional base of cured meats and expand its snacking offer.

As food retailing and food service converge, which is happening at pace particularly in the UK, meat isn’t sold as meat cuts, per se, but as the meal and/or snack solution. As those Gen. Z consumers grow older, they’ll require a shopping assistant to show them where and how to buy raw meat. For them, it will be an exciting outing enjoyed once or twice a year, like going to the zoo!

For domestic producers of meat (i.e. farmers producing livestock for their national market), a worrisome implication of the trend towards consumers eating meat more in processed form than fresh is that it increases the opportunity for lower cost international meat producers to broach new markets – for example, if pork or chicken are the ingredients in a “value-added” processed meat product rather than the product itself, as they would be if on the chilled meat aisles of a supermarket, the less notice consumers will take of the origin of the meat ingredients. This risk is similar for meat sold via value/cheaper food service outlets – most consumers don’t ask “where does this chicken come from?” when buying fried chicken or nuggets at the end of a boozy night out, or when tired children are screaming for food towards the end of the afternoon of a family outing!

To finish, seafood competes directly with land-based meats for the household protein and “Centre of the Plate”. Rabobank advise that “seafood is poised to surpass poultry as the leading contributor to global protein supply growth”. Sea creatures are the Number 1 meat in Portugal. In many Asian countries, seafood consumption is at or above “chicken levels”. Some fish species can compete on price with chicken – Pangasius, a pond fish, aka catfish or Basa. It’s a tasty fish for the “Income Have Nots”, whereas “Income Haves” can feast on wild salmon, tuna and lobster, with middle incomers selecting farmed seafood such as salmon, sea bass and prawns. If you’re in the meat business, then, you’re into protein whether it’s produced on land or in the water.

Keep in mind that the world’s biggest packaged food company and, certainly, the largest protein company is the Brazilian behemoth JBS (food revenues of close to $80bn. in 2024). JBS started in beef, added pork, chicken and lamb, moved into farmed salmon and has just acquired a company to make it the largest egg producer in South America. Its intent? To consolidate and enhance its position as the world leader in protein for human consumption. There must be something in the water in Brazil! Its biggest competitor Brazilian company Marfrig (the world’s 7th biggest packaged food company) has just gained approval to merge with BRF (Brasil Foods) to increase its international competitiveness. Four of the ten largest food companies in the world are in the meat business. The big are getting bigger presenting challenges to those “stuck in between” as to where and how they can differentiate their products and services and best ply their trade.

David Hughes and Miguel Flavian

October 3rd, 2025