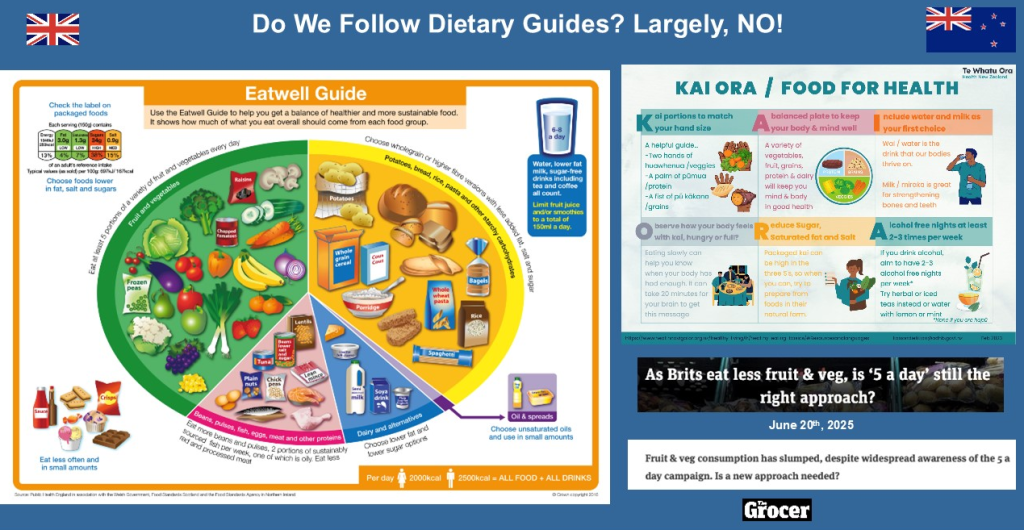

Wherever one looks. North America, Europe, Australasia, Japan, per capita fresh fruit and vegetable consumption is drifting downwards. What’s going on? Everybody knows that they’re essential for our health but very few of us get even close to meeting our 5-a-day targets. The UK Eatwell Guide and the New Zealand equivalent infographic are resplendent with fresh produce which look pretty on the kitchen wall, but they attract dust rather than attention! Fresh produce market volumes may show a slight increase, but these are driven by rising population not individual households eating more.

The most influential factor constraining growth in many countries is the rising retail prices of fresh fruit and vegetables. Recent Reserve Bank of New Zealand research notes price increases of 45% between 2014 and 2023 outstripping those for processed foods which rose by only 14%. For those households challenged to pay their mortgage/rent, grocery bills, energy and transport costs, etc., and such numbers have mushroomed during the 2020s, filling family member tummies has become a price per calorie battle and processed foods, typically HFSS (high fat, sugar, salt), are a fraction of the cost per calorie of most fresh fruit and vegetables. The UK Food Foundation calculates that “value” ready meals and processed meat are half the calorie cost of fresh fruit & veg. Dismally, escalating fresh produce retail prices are not necessarily reflected in higher prices to farmers. Their production costs have risen disproportionately, and their margins squeezed by ferociously competing retailers. What hasn’t helped has been extreme weather in many parts of the world causing supply chain disruptions driving prices even higher. Processed food companies have been more adept at capturing the eye of the food consumer through tracking and responding to consumer trends and launching promotional initiatives whereas fresh suppliers, typically, have focused on producing and relying on their retail customers to present and promote produce as they seem fit!

So, when it comes down to selecting our food products, is it only about price? Not necessarily. Take the UK fresh fruit market where the outstanding category over the past 20 years has been fresh berries. This year, fresh berry retail sales are 30% of the total retail value of all fresh fruit. 10 years ago, that figure was 20%. Yet, fresh berries have an average retail price/kg. 4 times that of apples which have seen their value market share of the UK fruit bowl slip from 21% to14% over the same period. Clearly, shoppers will pay more for what their families enjoy even although it may pinch their purse. The success of fresh berries has been global: taste and 52-week availability have been transformed; they’re snackable and firm family favourites. In the UK, casting back over the past few decades, snackable fruit such as berries, grapes, easy peel citrus have burgeoned whereas traditional favourites such as apples, pears and oranges have floundered. Mind you, the world’s most consumed fruit, bananas, combines snackability, strong kids’ acceptance and low price – feel sorry for Latin American producers because, in the UK, retail prices for bananas are the same as they were 20 years ago. At less than £1/kg. bananas are essentially a “free good”.

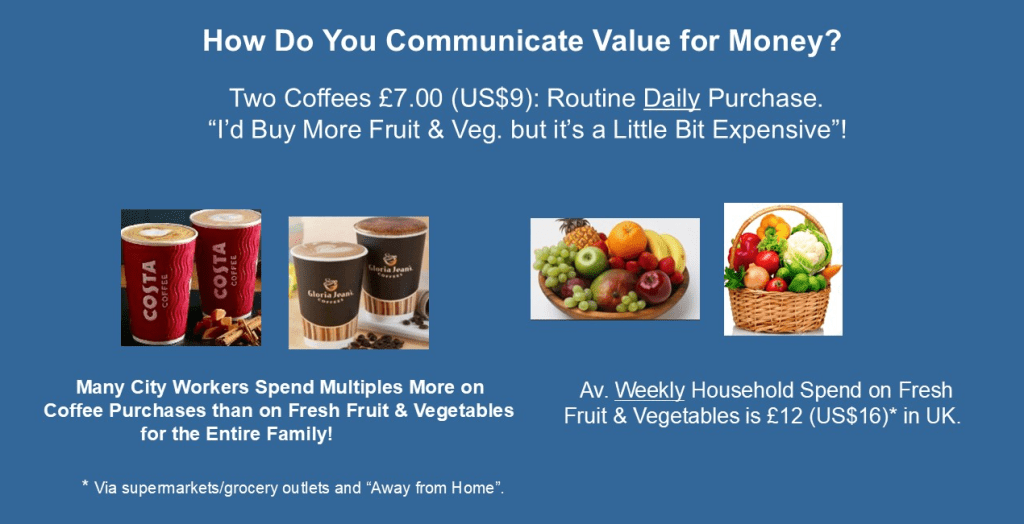

It’s a truism that fresh fruit and veg. are indispensably healthy but are perceived to be expensive. In consumer surveys across the globe, a common response is “I’d like to buy more but they’re kind of expensive”. Yet, many urban workers spend twice as much on their coffee purchases in the week than they do on fresh fruit & veg. for the entire family! Sadly, fresh produce is not addictive like coffee, nicotine and alcohol. The challenge is to present fruit & veg. in a form that meets consumer requirements and to communicate its cracking value for money and contribution to family health.

Whilst fresh fruit & veg. per capita consumption may be down in the dumps for some produce, but that’s not the case for frozen produce. In the UK, both frozen fruit and vegetables have seen modest but consistent upward movement over the past decade, accelerating through and after the Covid period as households saw advantages of frozen in terms of price, storability (shelf life) and reduction in food waste. Focussing on vegetables, it’s probable that this trend may be longer-term. Clarence Birdseye gave them a start in 1929, not least with peas and, in the 1940s, the Simplot Company caused a splash with frozen French fries. Who shells peas from fresh now or peels and slices potatoes to fry on the stove for chips? Cadbury’s iconic Smash Martians popularised “instant” mash potatoes in the 1970s (remember the advert.? “For Mash Get Smash”) and the brand is still on the UK market courtesy of Premier Foods even now. However, chilled mash potatoes for long a popular item in the USA (Kroger supermarket chain has 386 chilled mash products on its website) are now having a day in the UK and elsewhere. Tesco has 20+ mashed potato products online and the standard own label mash at £1.32/kg. (US$1.77) with a Clubcard is a snip.

Consumers aren’t quick to embrace new forms of traditional products, but they do move along a continuum, taking chilled mashed as an example, from Never to Occasional to Routine purchase through time. Convenience is an overwhelming driver! It’s a route that is likely for vegetables that are most under the gun in terms of family acceptance – such as “the hard veg.” beetroot, carrot, parsnips, squash, sweet potatoes sliced, frozen and ready for air frying. Chilled, chopped onions are another value-added product that is edging its way into the fridge of would-be meal preparers who are short of time.

What of frozen fruit and ambient processed fruit products. They don’t count in our measure of fresh fruit, but they are pervasive and growing in demand. We train our children to consume fruit from pouches. They progress through childhood into early adulthood swigging fruit smoothies. Per capita fresh pear consumption is dwindling in the UK. Indeed, every time David sees a hearse go by, he’s anxious on 2 counts: could it be one of his mates; and, for certain, there goes another pear consumer given the ageing demographic of the UK fresh pear market! The baby that sucks from a pear pouch will progress to slurping a fruit smoothie snack (1 of your 5-a-day) and on to the giddy heights of a super smoothie as their fruit palette sophistication blossoms to enjoy squished lychees, apples and dragon fruit with extra vitamins. Frankly, if you gave most UK teenagers and early-twenties a fresh whole pear, they wouldn’t know what to do with it!

Returning to the giant pumpkin in the room, i.e. declining per capita fresh fruit & veg. consumption. Does it matter? Well, yes if you believe that fresh fruit & veg. have a contribution to improving the dietary health of the world. Notwithstanding the emerging prospect that AOMs (Anti Obesity Medications) are arriving, like the cavalry, to stem the global obesity crisis. Worldwide, governments are desperate to encourage healthier eating. The UK has released a 10-year plan for our creaking National Health Service and has an agreement with major food retailers and manufacturers for them to report, using an accepted nutrient profiling model (NPM), progress in increasing the proportion of healthier (i.e. non-HFSS) foods and achieving stretch targets. This sounds positive for those in the fresh fruit & veg. business! Our major supermarkets are in concert with the aims: Tesco will reward customers with extra Clubcard points for buying more fresh produce; Sainsbury’s has a somewhat more complex programme, based on its Nectar loyalty card, for those buying “Healthy Choice” food products. Others across Europe are on the same page. Even the normally disciplined, super fit, stick thin Swedes (the nation not the vegetable) – ICA the grocery market leader in Sweden is lowering prices for key fruit and veg. items and launching “Join the Fruit Reboot” presenting fruit in a more modern, child-friendly way (only 1 out of 10 Swedish children achieve their 5-a-day target). In the UK, VegPower has seen success in casting vegetables as villains and calling on children to “Eat Them to Defeat them”. In Australia, the International Fresh Produce Association (IFPA) has launched its “Fruit and Veggies Yummy Yummy” campaign with The Wiggles Family encouraging children to explore, cook and enjoy fresh produce. All of these initiatives are helpful but far from being sufficient.

To revisit the 2 principal reasons why per capita fresh fruit & vegetable consumption is declining. First, exacerbated by many households being in “a cost-of-living crisis”, there’s the high cost per calorie of fruit & veg. and, even when through retail promotions fruit & veg. can be astonishingly (from a producer perspective, worrisomely) affordable, it’s perceived to be “kind of expensive”. Yet, in the UK, average weekly household spend on fresh fruit & veg. is only £12 (US$16). Second, even although most shoppers intrinsically know that serving more fresh fruit and veg. is in the best health interests of themselves and family, if the kids don’t like it and if it takes time, and for some, knowledge to prepare it, then, we’ll skip it and buy something pre-prepared. These are tough negatives but, onwards! We must accept that convenience invariably trumps health concerns. How a Baby Boomer (60+ yrs.) defines convenience bears no relationship to how a Gen. Z (13-28 yrs.) defines the term. Going forward, fresh fruit & veg. will increasingly be sold in a “value-added” format – removing labour and need for expertise from its preparation and use in meal/snack-making. Remember, whereas David’s Mum used to pop down to the grocer to buy ingredients, Gen. Z are not even familiar with the term and simply seek meal and snack solutions.

Retail presentation can be much improved for fresh produce, often, by simple cross-merchandising. For, say broccoli florets, make sure they’re adjacent to appropriate dips, sauces, hummus, etc. Marks & Spencer place the cream next to the strawberries. Avocados are in vogue and place the whole fruit next to the guacamole and avocado smoothies. For any fruit and vegetable item, take a leaf out of the avocado marketing book and create/magic up another eating occasion for your product – smashed avocado as a breakfast emerged in Australia in the 1990s and quickly became fashionable around the world. Is there a TikTok marketing opportunity for you? – check out the Canadian TikTok cucumber salad champion who rocked the global cucumber supply world!

To finish, fresh fruit and vegetables are widely considered the quintessentially healthiest food category. Yet, consumers elect frequently to ignore this attribute in our choice of food. We observe that within the fresh produce departments of most supermarkets, there is VERY little noise made about the specific health attributes of produce. If you want to know about how healthy berries and cucumbers are, go to Boots the Pharmacy and browse the beauty product shelves!

Some internationally branded fresh produce companies do promote their products on health – Zespri comes to mind (their kiwifruit vitamin C content being double that of oranges!). In China, Joyvio. the blueberry brand leader identifies eye health as the key attribute. Why is the fresh produce industry so shy in front of the shopper? Is it because we have a commodity orientation and who’s going to pay for the promotion? Scottish premium salmon trumpets that 1 salmon fillet provides our omega 3 requirements for the week. It’s important to identify the specific health benefits that attracts each consumer group – such as heart health for the older, skin health particularly for women, brain health for Mums (not theirs, their children!). At a time when consumer concerns about UPFs are on the rise, make sure that on your front of pack you have your ingredient list, e.g. for carrots, state Ingredients: Carrots!

If you’re still with us, Thanks. Do enjoy your Summer in the Northern Hemisphere and wear wool next to your skin in the furthest southern part of the Southern Hemisphere.

David and Miguel.

July 2025