The pandemic may be done and dusted but, by any measure, we’re living in turbulent times. Note to senior management, expect the unexpected! Mind you, we’re not going to run out of customers: over the next 25 years (up to 2050), world population is forecasted to increase by 1.4bn with almost all the extras being in Africa (+920m) and Asia (+450m) and a fair proportion of these will be Moslem or Hindus with meat protein implications to mull on for those in pork and beef. The European and North American share of global population will have shrunk from 17% to14% of total. Globally, average total food consumption is increasing by 6.5kg per person per year but, like the expected population increase, it’s not well spread out: 10% of our world are seriously under-nourished whereas 20% are obese and, in North America and much of Europe , 40+% are as round as puddings and are an unnecessarily “heavy weight” on our health systems. Plant foods – cereals and vegetables – top the food league table, although meat, dairy and egg products are global favourites where they can be afforded.

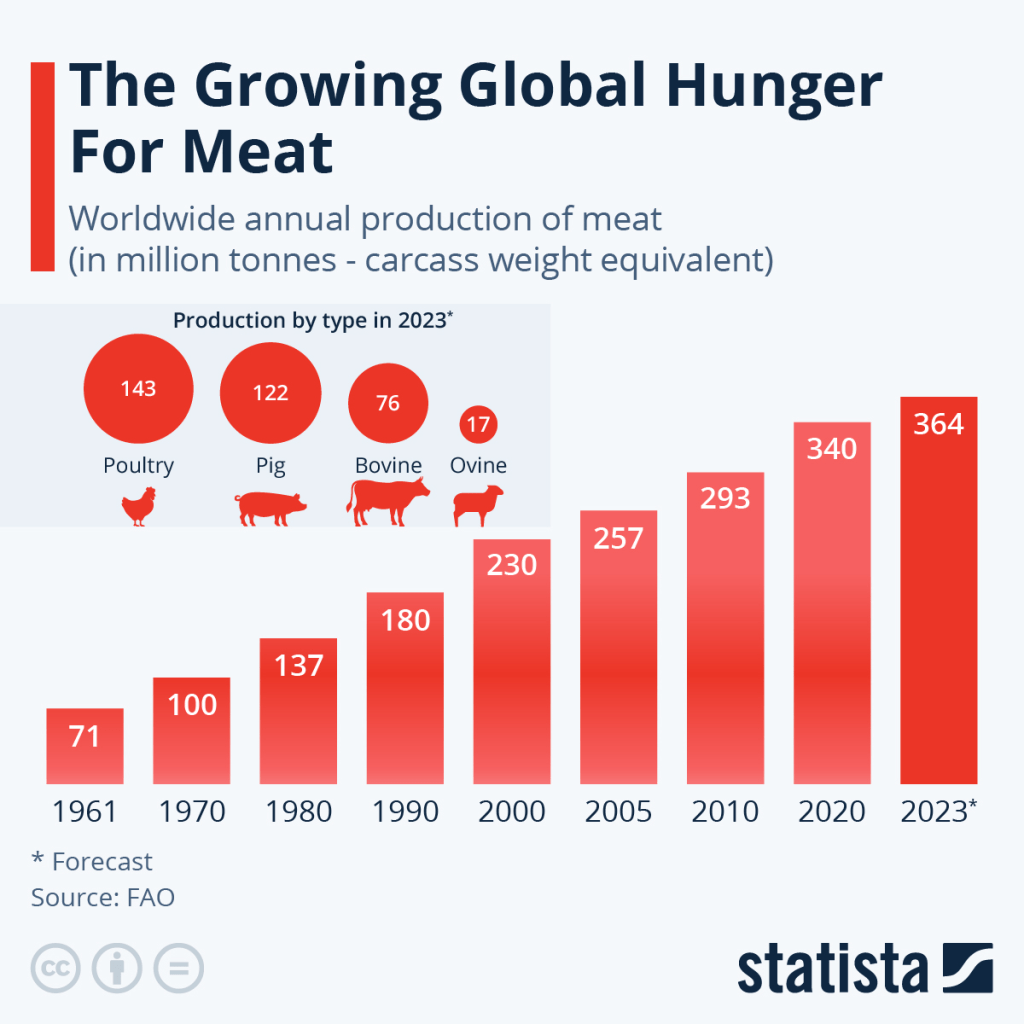

Focusing on meat, ALL the major meats have seen market growth over the past decade or more, but chicken continues its inexorable growth in global meat market share, usurping pork in 2017 to account for 40% of all ‘land-based meat” consumed in 2024. The “minor” meat lamb accounts for 5% of total with beef holding on to 20% or so share. Oddly, meat statisticians and “Big Meat” internationally, often, don’t appear to consider seafood as being a meat protein choice for consumers, yet fish & seafood are preferred options in much of Asia and Rabobank forecasts that seafood will contribute the largest gains in global protein supplies in 2025 and on, dethroning poultry as the growth leader. The future of plant-based “mock meats” and cell-based meat? Clearly, the former are on the downward curve of the “Gartner Hype Cycle”, not surprisingly as consumers thought early versions tasted dreadful, were expensive and had worrisomely long ingredient lists. Cell-based are past “peak excitement” albeit are continuing to attract venture capital with a longer-term view. Research colleague Miguel asks me “when will cell-based meats attain commercial scale and be on the shopping list of a proportion of consumers?” and my stock reply is “Not in my lifetime ….. (sigh of relief from commercial carnivores) but then, I’m not in the first flush of youth”!

Global dairy is chugging along nicely (dairy products are the world’s 3rd most consumed food group) but their consumer use has been changing rapidly. Plain milk, in a bottle or pouring on breakfast cereals, is yesterday’s use, whereas quaffing a dairy protein shake and woofing down a mozzarella-wrapped pizza is à la mode for Gen Z and Millennials worldwide. The Top 10 of the global dairy processors are advancing at pace, via acquisition, and for good reason – processors with sales of $600+m are up to 50% more profitable (EBIT) than smaller fry.

The egg industry future looks similarly rosy to dairy, notwithstanding the scourge and challenges of Avian Influenza. Scale and profitability are important here, too. The USA egg market leader, Cal-Maine Foods, has revenues of $3+bn and collects eggs daily from 45m hens, making this one company larger than the entire UK egg industry. “Kong Meat”, Brazilian giant JBS has just poked its nose into the egg industry through an acquisition making it the largest egg producer in South America. If you want to see excitement in the out-of-home egg market globally, go to Asia where eggy products have long been firm favourites. Try a yummy Korean branded “EGGDROP” sandwich. It’s in Southeast Asia where innovation in food is buzzing. The region has modest population growth (increasing by “only” 55m by 2033), but household income is galloping along relative to slow growth Europe which is indicative of expected strong future demand for livestock protein products.

What of the future of sustainability of global food production? Around the globe, consumers are increasingly conscious of what they put in their tummies has a profound impact on their own health and the health of our planet. Skimming past a range of hugely important global human health issues, the relatively recent arrival of AOMs – new acronym – anti-obesity medication is starting to cause early and frantic stirs of concern on some food markets. AOMs have certainly taken the attention of big FMCG players, smarting over being sat on the UPF (ultra processed foods) naughty step by food nutrition evangelists. Survey results show that AOM users tend to cut back on snacks and fizzy drinks and increase their intake of healthier protein foods which is good news for those producing meat, dairy and egg products.

In January, The World Economic Forum published its annual global risks report for 2025. Looking at the Top 10 risks over the next 10 years, WEF identified environmental issues as the top four most likely to have an impact on business, viz. extreme weather events, biodiversity loss and ecosystem collapse, critical change to Earth systems, and natural resource shortages. In general, and around the globe, consumers recognise that we’re running out of time to fix the problems that could destroy our world. However, saying this and then doing something about changing their purchasing behaviour and, say, reducing in-home food waste and improving recycling is another matter (the “saying but not doing” conundrum). Barriers to consumers shopping more sustainably include perceived expense of “green” products, difficulty in searching for them amongst the thousands of grocery items on supermarket shelves, lack of knowledge about what is best to buy, dissatisfaction about the efficacy of some “green” products, concerns that “big business” claims are, often, simply “greenwashing”, and “I’m too busy and worried about the food bill/my mortgage/rent to worry right now about sustainability ”.

Last year (2024) was the first calendar year that our world reached, indeed exceeded 1.5 degrees Centigrade above the pre-industrial levels and it was no blip! Is it hopeless and we’re doomed to a hellish hot future through inaction? No, although we better get a move on. In 2025, the 30th annual UN Climate Change Conference (COP25) will be held in Belém, Brazil. Back in 2015, most national governments signed a promise to undertake actions on reducing our carbon impact, halving food waste, etc. by 2030. You don’t have to stand on a chair to see 2030 from here and leading “developed nations” are nowhere near delivering the environmental outcomes promised. Yet, the manifestations of global warming are increasingly self-evident (e.g. January 2025 was the hottest January on record) and responsible governments recognise that “needs must” or we will irreparably damage the future of our countries. Try and explain inaction to your grandchildren! Forward-thinking governments are grasping the nettle (e.g. last year, Denmark confirmed the first carbon tax for its farmers) but it can come with a political sting – note Dutch livestock farmers furious response in 2023 to the threat of being forcibly purchased in order to cut Dutch nitrogen emissions which led to the fall of the government and sharp swing to the right in a shock national election .

In the marketplace, smatterings of meat, dairy and egg products are on-shelf with methane/carbon-reduced labels. The principal retail vendors of most countries’ grocery products, the large supermarket chains, have like their governments made promises, too (e.g. Tesco – carbon net zero across its full value chain by 2050). Contentiously, mind you, because such promises largely relate to reducing Scope 3 emissions which account for the lion’s share of the environmental impact along the food chain and these principally relate to activities on individual farms. Thus, the substantive actions to edge towards carbon net zero must and will be made on farms led by those who are trialling improved management and agronomic techniques, supported by businesses in the vanguard of developing low carbon farm inputs, and accelerated by blisteringly exciting technology such as AI and gene editing. How and when this will all happen is for others more qualified to tell. But, for certain, fast forward a decade from now and livestock products and livestock feed will have significantly lower “Enviro Scores” than they do now.

Around the globe, commercial agriculture is simply increasing in scale. The investment cost to be at the leading edge of food production has accelerated through this decade and will continue to do so. A big green grain combine can cost £1m/$1.25m! Fewer and bigger is the farm business trend across livestock and cropping. Mid-20th Century saw the global “Green Revolution” fuelled, in part, by significant public sector funding (national governments and World Bank) but as we fast forward through the present “Technological Revolution”, private sector funding is dominant and there’s a substantial entry cost for those food producers who wish to be on board. Where does that leave smaller-scale farmers? Scrambling, as ever! For consumer-friendly smaller-scale farm businesses, niche markets which could be local and/or for specialty food products can be attractive if the farm “offer” is accompanied by compelling stories about provenance, family history, production process, etc. Many will certainly require, where and if available, policy support to provide them with income opportunities through “greener” farming, as per in England with its Environmental Land Management payments (aka ELM “public monies for public goods”), more sympathetic planning regulations such that they can diversify into tourism (e.g. glamping) and other non-farming activities (e.g. storage, small-scale industrial units) and, for some, just working “off farm”.

Globally, the future for meat dairy and eggs does seem bright notwithstanding that our world is turbulent – politically, socially, economically and environmentally. In regions where incomes and protein consumption are relatively high, population growth is low and notably ageing (e.g. Europe, North America, China) expect to see flat growth in total demand as portion size diminish but frequency of consumption remains at current levels (consumers are simply fond of meat, dairy and egg products and are very reluctant to give them up!). Consumer concerns about the environmental impact of producing and eating livestock products will soften as the livestock industry responds with lower carbon impact products. Where meat and dairy consumption is low and household incomes are low but rising quickly expect to see significant market growth. Consumers in such regions are environmentally conscious, too, not least because they are often in parts of the world that are most susceptible to damage from climate change. Farm livestock are huge emitters of greenhouse gases and, globally, if we don’t manage a significant reduction in their GGEs our grandchildren will be eating less livestock protein!

David Hughes and Miguel Flavián, February 2025