Fresh food – fruit & vegetables, meat, etc. – takes a battering when household incomes are under stress. In the meat department, chicken sales soar as they’re the lowest-priced protein. For fruit & veg., the research evidence is scanty, but it seems evident that many household shoppers (often, Mum) allocate a notional amount of spend, say £10 (A$20) in “normal” times, but when pinched, this amount gets whittled down. Per capita consumption of fresh produce has declined over the past 3-4 years in most major markets. So, do the income-stretched focus on the cheapest fruit & veg. they can buy? Not necessarily, across Europe, North America and Australasia, relatively expensive fresh berries have taken market share from cheaper alternatives – berries, even in hard times, are “treats” for children and adults. In the UK market, apples, regular citrus and stone fruit sales suffer.

Being in the food industry isn’t for the faint-hearted, particularly during periods of high inflation, not least of rocketing prices of the major inputs used by farmers and processors in producing food. In March, 2023, food price inflation approached 20% in the UK. The Summer of 2022 had seen fertiliser and energy prices triple from 18 months earlier. Farmers and food consumers were outraged and called for the villains to be identified and punished! It was ever thus – back in 1973, when harvests failed in the USSR and OPEC cut back oil production as a response to the Arab-Israeli War (history repeating itself?), farmer and consumer organisations demanded government commissions of enquiry, retailers refuted bullying accusations promising fair play in their dealings with suppliers, and the media had a field day identifying profiteering scallywags. This is far from being just a UK thing – food producers in Europe, North America, Australia and New Zealand have been incandescent and sought government action to counter supermarket flagrancy!

There’s been much talk in the UK and some action in response to producer concerns: such as strengthening The Grocery Supply Code of Practice (GSCOP) and establishing a statutory Food Security Index. Special attention has been given to producers of chicken, pork, eggs, fruits and vegetables. Lidl is “investing £500m to bolster the British pork sector”, although likely the hard discount chain won’t be handing out bags of cash to its pig farmers. The recent government announcement at the 2024 Farm to Fork Summit of substantial support to food producers look parsimonious by comparison. However, horticulture did get special mention for assistance to raise our self-sufficiency in fruit from its lowly 17% level and our vegetable self-sufficiency up from its current 55%. Tesco has partnered with NatWest Bank to launch a discounted climate and sustainable farming finance scheme offering lower rates for regen.-type farming practices. Waitrose has a Dr. Dolittle “Pushmi-Pullyu” look about it: “for the good health of consumers, we’re slashing prices again on vegetables” which won’t translate into healthy margins for farmers, whilst it supports 2,000+ of its dairy, eggs and livestock farmer suppliers to transition to, initially, higher cost regenerative farming practices by 2035. In time, food and farm input markets will stabilise and margins will recover to more acceptable levels (cold comfort for those businesses “collaterally damaged”).

Will the initiatives undertaken over the past couple of years provide protection for horticultural producers when the next price and/or climate crisis comes our way? Probably not! So, what’s the future-proofing strategy to put in place?

- At a time when food consumers are (or, certainly, say they are) seeking foods that are good for the family’s health, then, fruit & vegetables should be supremely placed (in the box seat, as Aussies say). Look at the traffic light “nutri-scores” on produce sold via Dutch or French supermarkets – luminously green. Attributes relating to the heart, weight loss, gut and skin gain strong approval. Natural, “clean” ingredients catch the eye, not a worrisome screed of chemical names that are associated with Ultra Processed Foods (UPF). With very few exceptions, packaged fresh produce bafflingly makes no health claims at the retail shelf. Whilst packaging can still be used for fresh produce, stick the benefit on the pack and/or the shelf barker! Don’t assume the shopper will have the intrinsic benefits front-of-mind. Be assured, if a FMCG food or cosmetic product has the smallest sniff of a health/beauty benefit, it’ll shriek it from the rooftops (e.g. processed food products with blueberries as a minor ingredient will be slathered with antioxidant claims). Mimic processed products and, on the pack, state plainly: Ingredients: broccoli! Vegetable-based meals are on-trend. Not crap plant-based meats, but exciting/exotic main dishes using fresh (or frozen) vegetables. As a horticultural industry, we’ve just got to be way more on the front foot when communicating the intrinsic healthiness of our products.

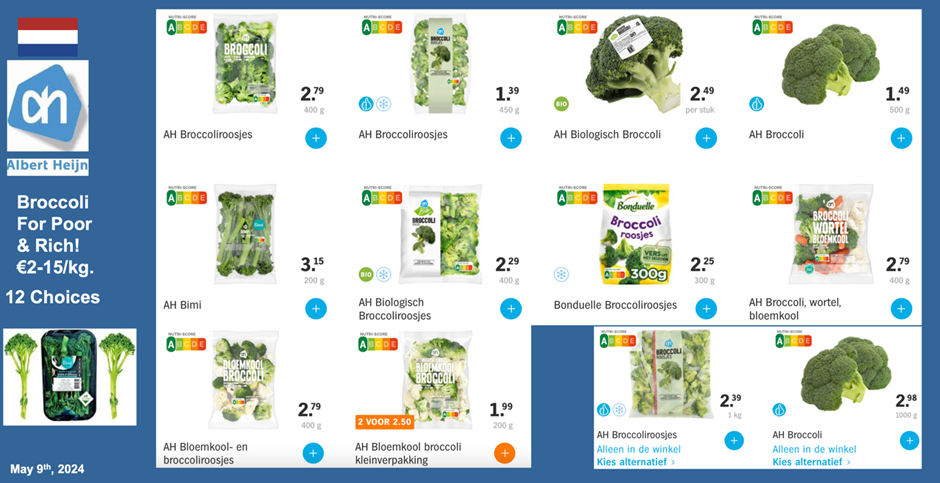

- In the fresh produce aisles of stores and, particularly, on the web pages of online shopping, category presentations are, frequently, overwhelming. This is a retail issue over which supply chain members have little or no influence. In the fresh tomato category, there can be dozens of SKUs. Go in a store and watch bemused shoppers end up selecting the cheapest on offer because they can’t make out what are the benefits of the more expensive products and, be assured, they’ll not find any produce staff on hand with tomato nous. RedStar, the impressive Dutch tomato producer, reckon that 75% of in-store shoppers abandon their search and select the tomato product that is on offer and the lowest price. You’d think presenting category assortment online would be much easier but take a peek, it’s a nightmare. Tesco.com has 63 fresh potato SKUs over 3 web pages. If your product is on Page 3, likely you’re a goner! Most online shoppers never get past Page 1 (for sausages, there are 140 SKUs online and on 6 pages!).

Better definition and presentation of a category is in the best interests of all in the supply chain and it should be based on a profound understanding of consumer requirements and their emerging usage of the products in question – are the tomatoes for a regular or special meal, salad, sandwiches, snack, fancy garnish, or for cooking? Make it easy for the shopper to buy the “right” product for the “right” eating occasion.

- Should packaging be banned on fresh produce to save the planet or allowed to save quality and shelf life? We really need to do both! It’s an international problem: leaving produce bare naked gives shoppers the opportunity to embrace the full theatre of touching and smelling fresh fruit & vegetables but brings with it the real risk of damage to the produce and more waste. When David lived in the Caribbean, it was the bane of market fruiterers that shoppers would snap the tops off okra (lady’s fingers) to check that it was fresh and, then, they’d discard the snapped ones to buy “perfect” produce. In our supermarket produce aisles, unwrapped avocados and stone fruit are pummelled to check for ripeness leaving bruised fruit for customers following! But, there’s a technological solution at hand. European retailers Jumbo and Migros are trialling in-store scanners to check the ripeness of avocados. It’s working and driving sales!

- Most fresh produce retailers in many countries offer the 3 tier range of “Good”, “Better” and “Best” products and they seek a select set of suppliers that can cover their 52-week supply needs. The “Good” part of the fruit and vegetable market has become increasingly commoditised. Bananas are the quintessential example: 99% of bananas exported are the Cavendish variety. In the UK, average retail price per kg. has clawed its way up from 83p in 2007 to 99p/kg. now. Essentially, bananas have become a “free good”! There are brands (e.g. Chiquita, Dole, Fyffes) but, in fact, they’re not much more than sticky labels! The challenge for other fresh produce businesses is not to fall into the dreaded commodity trap. Yet, many “Good” (i.e. value aka cheap) fruit and vegetables are clearly straying into commodity territory – e.g. standard apples, grapes, root crops, brassicas. Long-term business survival as a “Good”/value supplier requires international cost competitiveness, scale, a track record of delivering the quantity and quality promised, a range of customers that may be in processing of premium and sub-retail standard produce, and a produce offer in higher margin “Better”, “Best”, and value-added.

- For most produce suppliers, ownership of the intellectual property (IP) associated with premium (“Best”) produce is a step too far. Accumulating and owning varietal R&D is a long-term, expensive business. There’ll be a requirement to be a licensee working with a seed company and/or producing for a company that holds the seed license for a territory or country. For example, Japanese seed company Sakata owns the IP associated with a kale and broccoli hybrid. In the UK, it carries the brand name Tenderstem and is grown by a few, select growers. In the EU it’s named Bimi, and in Australia Broccolini. Whatever the market, its retail price is 4-5 times that of bog standard (nonetheless delicious & healthy!) broccoli. Production costs are significantly higher than large-scale ranched broccoli but so are margins for these premium items. In the UK and EU, this branded product receives marketing support from Coregeo, a company that focuses on managing the branding of fresh produce. Coregeo won its spurs on developing the Pink Lady apple brand (note the huge price multiple that these apples earn versus Aldi-price matched apples in major supermarkets) and is building the Gem avocado brand for IP owner Wesfaliafruit.

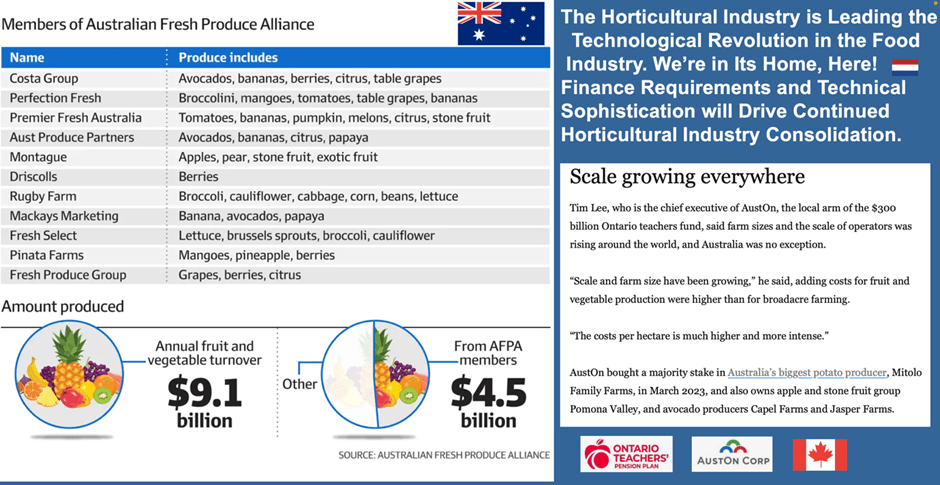

- Through the remainder of this decade and on, horticulture will see substantial consolidation as the technological revolution in the industry accelerates – gene-editing, robotics, AI, energy from solar/wind/biodigesters and more. Keeping up requires increasingly deep pockets and favours larger, better-resourced businesses. In Australia, half of the turnover of the fresh produce industry comes from just 11 companies, several of whom have received private equity financing in very recent years. Is the game up for smaller-scale businesses. Certainly not, but they better have a Plan B handy. Best start with an assessment of what is your business’s strengths and weaknesses. What’s your point of difference with the final consumer and with your customers? What do you bring to the party that’s unique (your USP, if you will)? Options could include:

- niche marketing strategy and developing a local area brand;

- keep well away from the big fruit & veg. commodity players who have the scale to exist on thin margins;

- choose a minor product that has scale for you but not for the bigger players;

- focus on developing close relationships with a single, significant customer in both the retail and food service sectors;

- or, why not take a cold, hard, realistic view of future developments and decide whether this is time for a sale whilst there’s value in your business and take the money and run!

- As a horticultural industry recognise that, jointly, we should raise our game. Nearer My God to Thee, for goodness’ sake, we’re in the health food game at a time when consumers are showing increasing interest in wanting to feel well physically and mentally not least younger ones. They want healthier families and increasingly recognise that healthy living means following a healthy, nutritious diet. In the UK, a change of government is imminent. “Saving the NHS” (state health service) will be near the top of the list of the newbie government. Here’s a huge opportunity to work in partnership with the health authorities to raise spend and consumption of the products we produce. Remember, in the UK, average weekly spend on fresh fruit & vegetables purchased from retailers is under £10 per household – that’s 4 cheap takeaway coffees! Onwards and upwards but remember, healthy food are important to consumers but they’re trumped by taste and convenience. Our industry motto: “We’re The Leaders in the Tasty, Convenient, Healthy Food Game”!